Antares Fixed Income believes that debt markets are not completely efficient and as such, opportunities can be identified and exploited in a systematic way. Antares Fixed Income portfolios are constructed with the aim of capturing income whilst minimising the risk of capital loss.

Superior returns for a given level of risk can be delivered by investing in a broad set of opportunities and using a diversified range of strategies. Antares Fixed Income seeks to maximise returns across a range of economic cycles.

Antares Fixed Income retains a stable, collaborative and experienced team of investment professionals, who have managed investment portfolios across a range of economic cycles.

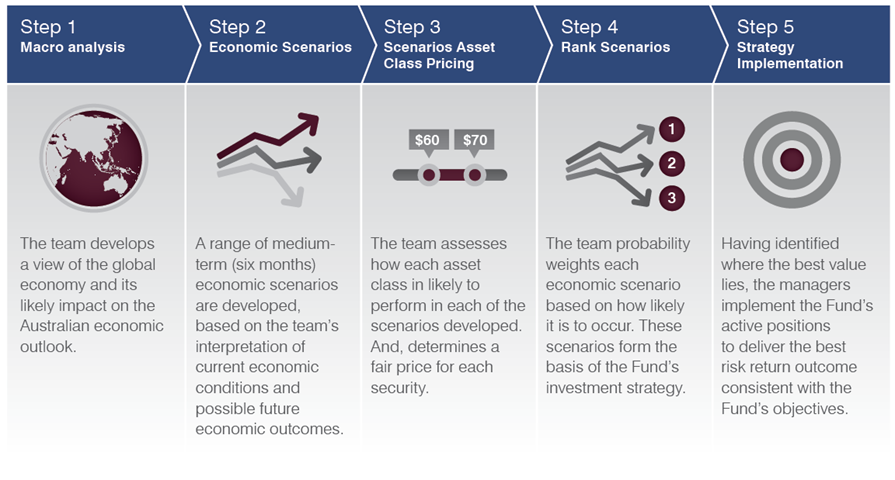

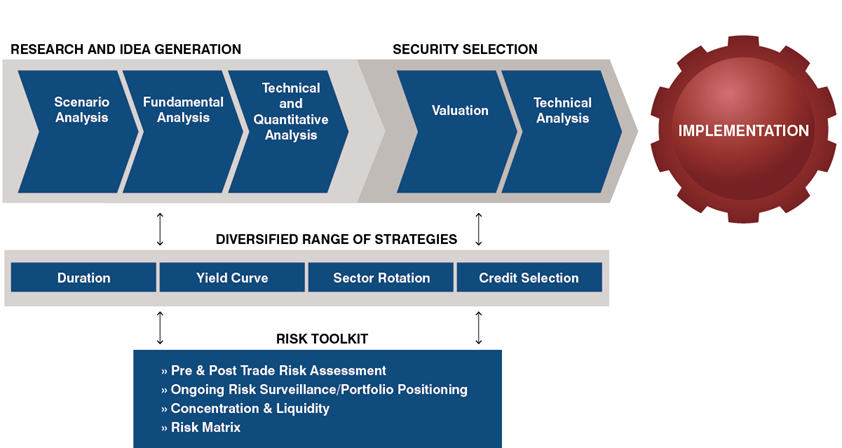

Our Process

Antares Fixed Income investment process can be summarised in the below charts:

Responsible Investment (RI)

Read Antares RI policy.

Risks

Risks specific to investments in fixed income instruments may include credit and default risk (i.e. the risk that the issuer of security owned by the relevant fund may not meet their obligations to make interest payments, the repayment of capital or both), interest rate risk (the value of the relevant Fund’s investments may be sensitive to changes to interest rates), inflation risk (the risk of inflation being higher than anticipated), and liquidity risk (the risk of not being able to find a buyer in a timely manner). Please refer to the relevant fund’s offer document for more information.